Political Connections, Governance, and Financial Performance: The Case of the Biggest Canadian Listed Companies

- Saidatou Dicko

Abstract

We examined the links between companies' political connections and their accounting performance (ROA and ROE), market performance (Ln of Market Value), and the moderating role of governance in this relationship. The S&P/TSX Composite Index companies were used from 2008 to 2018, inclusive. We used two indicators to measure political connections: being politically connected (PC) and the Total number of such connections (TPC). About 37% of the companies studied have at least one political connection, mainly in the mining, oil, and gas sectors. LnMV only shows a significant difference between politically connected and non-connected companies. Politically connected companies have, on average, a higher market value than those without political connections, with a significant positive correlation between LnMV and the TPC. Regression analyses indicate that the relationship between Political connections and accounting performance (ROA, ROE) is not statistically significant. However, LnMV is positively related to PC but negatively associated with the TPC. Governance has a positive but weakly significant link with LnMV. The interaction between governance and PC is significant, showing a negative link with LnMV. In contrast, the interaction between Governance and the TPC shows a positive relationship with LnMV. Thus, the study suggests that political connections can influence companies' performance, but this effect depends on the quality of governance and the number of such connections. Our research is the first in Canada to show a relationship between companies’ political connections, governance, and market performance. Therefore, governance aspects must be considered when analyzing the impact of corporate political connections.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v20n5p158

Journal Metrics

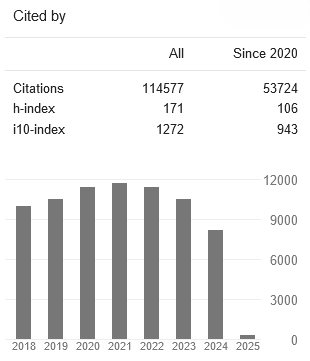

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- ACNP

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org