The Effect of Crowdfunding Criteria on the Intentions to Fund Entrepreneurial Projects: A Comparative Study between Egypt and France

- Yousra A. Abdelwahed

- Johannes Schaaper

- Hanane Elzeiny

Abstract

Purpose: With the rising trend to find innovative sources of finance and the increasing number of crowdfunded projects globally, this research attempts to analyze the criteria that encourage individuals to fund entrepreneurial projects through crowdfunding. The study develops a research model based on signaling theory, prior crowdfunding literature, and venture capitalists’ decision-making frameworks, to examine factors influencing crowdfunding intentions.

Methodology: A quantitative survey approach was employed, targeting crowdfunding participants in two distinct settings, Egypt and France. Data was collected using a self-administered questionnaire from 200 respondents, 95 from Egypt and 105 from France. Seven main hypotheses were empirically tested in the two contexts.

Findings: Using regression analysis, we identified six key criteria that significantly influence intentions to fund crowdfunding projects. These criteria include: (1) project’s stage of development, (2) reward nature, (3) externality, (4) popularity, (5) growth potential of the target market, and (6) the quality of the crowdfunding platform. T- test analysis was used to examine differences between the two contexts, comparing Egypt and France we found no significant difference in funding intentions. However, significant differences emerged regarding the importance of certain criteria: entrepreneur’s experience, education and gender, as well as the project’s development stage, reward nature, externality, popularity and target market growth potential.

Originality: This study fills a key research gap by offering a cross-country comparative analysis of crowdfunding. It introduces a new framework to understand crowd funders’ intentions, providing practical insights for entrepreneurs to improve fundraising success while advancing academic knowledge on cross-cultural crowdfunding behaviour.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v20n5p121

Journal Metrics

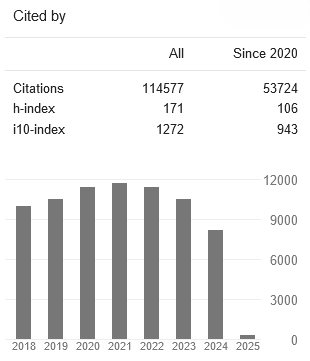

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- ACNP

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org