Determinant Factors of Cash Holdings: Evidence from Portuguese SMEs

- Corina Pastor

- Paulo Gama

Abstract

Adequate cash levels are fundamental towards smooth operations of firms. Managers have a tendency to hold a

significant share of firms’ assets as liquid assets in order to reinvest on other physical assets, payments to

stockholders and to keep cash inside the firm. Cash levels are influenced by firms´ capital structure, cash flow,

investments and asset management policies as well as by theirs working capital requirements, and dividend

payments. This paper focuses on analyzing the drivers of cash holdings of non-financial Portuguese

manufacturing small and medium sized companies (SMEs), for the period 2001 to 2007. Results show that firm

size, growth opportunity, relationship with banks, cash flow uncertainty, debt structure, liquidity and leverage

have a significant influence on the level of cash holdings of non-financial SMEs in Portugal.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v8n1p104

Journal Metrics

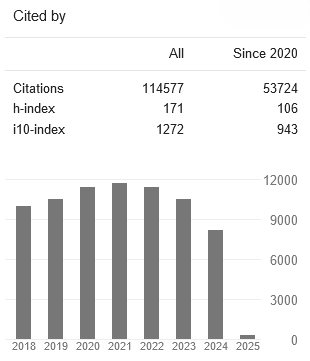

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- ACNP

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org