A Re-examination of the MM Capital Structure Irrelevance Theorem: A Partial Payout Approach

- Mondher Kouki

Abstract

Contrary to Modigliani and Miller (1958, MM hereafter), Capital Structure is not irrelevant when we consider a

firm with a dividend payout policy. This article extends the MM capital structure theorem by relaxing the full

payout assumption and introducing retention policy. The theoretical contribution shows that it is possible to

verify the theorem when we suppose an investor who exchanges his initial holding for another portfolio

composed of consumption and investment. The empirical analysis of this new approach is based on a data set of

the USA Electric Utilities and Oil companies for the period 1990-1998. The results show that the relationships

between leverage and firm value are significantly affected by the firm’s payout ratio. This finding is largely

inconsistent with MM’s view that the division of a stream between cash dividend and retained earnings is a mere

detail in dealing with the irrelevance of capital structure.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v6n10p193

Journal Metrics

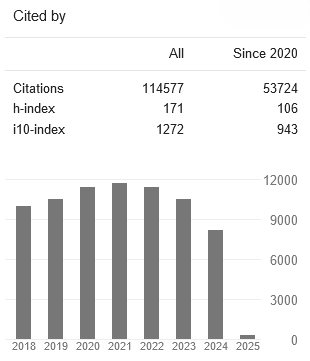

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- ACNP

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org