Fama and French (1993) Three-Factor Model: Evidence from Conventional and Shariah-Compliant Portfolios in Bursa Malaysia

- Hani Nuri Rohuma

Abstract

The main objective of this research is to test whether the style factors employed by the Fama and French (1993) three-factor model adequately explain the performance of four conventional sub-portfolios sorted by book value-to-market value (BVTMV) and their Shariah-compliant counterparts in Bursa Malaysia over the examination period from 1 December 2005 to 28 February 2018. To ensure the regression results of this research are unbiased estimations, tests for unit root, heteroskedasticity and autocorrelation bias were conducted on the regression variables. The regression test was conducted by regressing the monthly excess returns of the conventional and Shariah sub-portfolios on the monthly returns of the three factors of Fama and French (1993), which are the market risk premium, the small-cap risk premium, and the value risk premium. The results of this research revealed that the Fama and French (1993) three-factor model can significantly explain the performance of the four conventional sub-portfolios sorted by BVTMV and the four Shariah-compliant sub-portfolios sorted by BVTMV in Bursa Malaysia.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v17n7p66

Journal Metrics

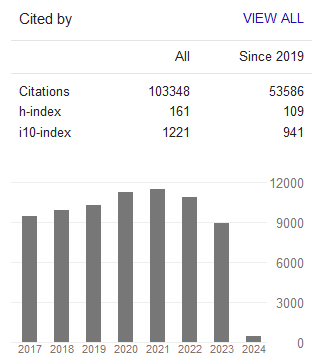

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org