CSR and Financial Performance: Trick Or Treat? A Longitudinal Study on Holistic CSR Practices

- Antonio Salvi

- Felice Petruzzella

- Anastasia Giakoumelou

Abstract

This paper aims to test the impact that a firm’s adopted CSR level has on its financial performance, in terms of accounting, financial and market-based measures. In particular, we employ a panel OLS analysis to test the effect of firm’s sustainable efforts (measured by the “Sustainable score”, a tailor-made variable) on three performance measures: return on assets (ROA), return on equity (ROE) and Tobin’s Q.

This work provides for methodological differences that led to divergent research results over existing literature in the field, examining the relationship of interest within three timeframes that exploit underlying dynamics over both long- and short-term horizons. Furthermore, we contributed to current knowledge focusing on the effect of holistic CSR practices on financial performance and examining the impact of the 2007 financial crisis on the relationship. To that end, we have employed a customized measure to represent effective CSR practices that go beyond CSR-washing cases and studies of CSR through single-dimension variables, while quantitatively exploring the relationship of interest within three separate time periods that span both before and after the financial meltdown of 2007.

Results highlight a positive relationship between the operating and financial performance of companies and their sustainability commitment. What is more, findings indicate that CSR individual actions do not produce any significant impact on firms’ performance, unless applied jointly through a holistic sustainability strategy. Finally, the relationship between the sustainability level of a firm and its financial performance presents various significance levels and temporal profiles, with the years to follow the financial downturn of 2007 presenting the strongest results as opposed to the absence of important influence during the pre-crisis period.- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v13n6p43

Journal Metrics

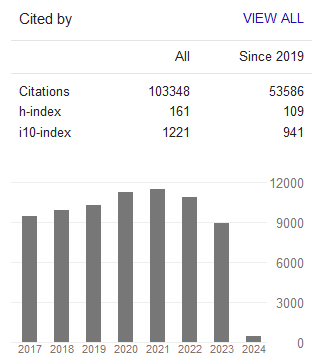

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org