Reviewing Conservative Relationship between Accounting and Corporate Governance Mechanisms

- Hashem Valipour

- Mostafa Sohouli Vahed

Abstract

This research has the aim of reviewing relationship between some corporate governance mechanisms and conservatism in financial reports. Conservatism is potentially useful for corporate governance in some ways: first it reduce opportunistic engagement of management against itself. Second, it results in management report about loss from selling assets and ceases operation and finally it prevents continuity of management investment in projects with negative net present value. Estimated coefficient of independent variable of ownership concentration is positive and their p-value is less than 5%, so it can be said that there is a positive and significant relationship between ownership concentration and conservative accounting and the first sub-hypothesis is accepted. Estimated coefficient of independent variable of BD (Board of directors) size is positive and its p-value is higher than 5%, so it can be said that there is no significant relationship between BD size and conservative accounting then the second sub-hypothesis is rejected. Estimated coefficient of independent variable of BD composition is positive and its p-value is less than 5%, so it can be said that there is a positive and significant relationship between BD composition and conservative accounting then the third sub-hypothesis is accepted. Estimated coefficient of independent variable of shareholder directors is negative and its p-value is higher than 5%, so it can be said that there is no significant relationship between shareholder directors and conservative accounting then the forth sub-hypothesis is rejected.- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v12n6p172

Journal Metrics

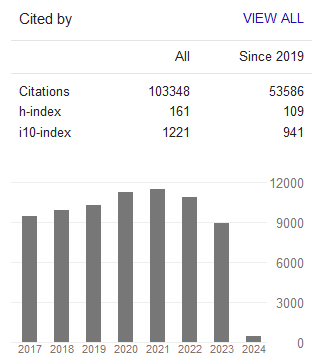

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org