Lessons Learned in Management, Marketing, Sales, and Finance Incentive Practices a Decade after the Subprime Mortgage Crisis

- Jason Thomas

Abstract

The subprime mortgage crisis was the most devastating financial crisis since the Great Depression. The steady rise of housing purchases and seemingly limitless increase in home values drew many investors to the United States real estate market. The business growth in this sector was so compelling that financial firms created new secondary markets that were perceived as diversifying risk, which in turn prompted lenders to create innovative funding vehicles and loose and fast loan qualification processes. The federal government was ill prepared to deal with this shift in the financial world to market-based demand, and the results were disastrous. Lenders embraced predatory lending practices, borrowers with bad credit overextended themselves beyond their means, and foreclosures occurred at startling rates as home values plummeted, resulting in a world-wide economic depression. Ten years later, we reflect on the events that led up to and caused the subprime mortgage crisis for lessons learned to improve management, marketing, and finance incentive practices.- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v12n3p19

Journal Metrics

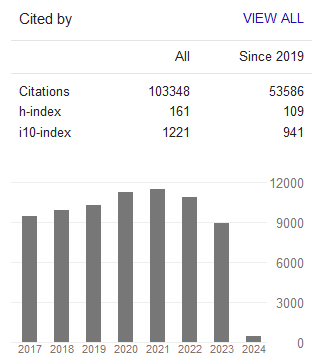

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org