Effects of Capital Structure and Managerial Ownership on Profitability: Experience from Bangladesh

- Md. Imran Hossain

Abstract

This paper aims at investigating the effects of capital structure and managerial ownership on the profitability of the Bangladeshi companies based on a strongly balanced panel data of 81 manufacturing companies listed under 10 industries in Dhaka Stock Exchange for 2002-2014. The results of Panel Corrected Standard Error (PCSE) regression model suggest that capital structure variables negatively affect ROA but positively affect ROE of the firms. Furthermore, Short term debt influences profitability of the firms more severely compared to Long term debt. On the contrary, managerial ownership positively affects profitability conforming to the Agency cost theory. It was also found that Bangladeshi firms followed aggressive financing strategies that led to an increase in their financial & bankruptcy risks to a great extent. That the financial managers should employ less leverage in the capital structure and minimize agency cost of equity in order to maximize the profitability of firms is the policy implication of this paper. EN-US style='font-size:10.0pt;font-family: "Times New Roman","serif";mso-ascii-theme-font:major-bidi;mso-fareast-font-family: 宋体;mso-hansi-theme-font:major-bidi;mso-bidi-theme-font:major-bidi;mso-ansi-language: EN-US;mso-fareast-language:ZH-CN;mso-bidi-language:AR-SA'>instead of evaluating an individual chain i.e. Service provided by Original Equipment Manufacturers to Telecom Service Providers or vice versa or from Telecom Service Providers to the End Users. Questionnaires feedback was taken from comprehensive chain of services, i.e. forward and backward chain feedback was considered. Research findings suggest that technological support would improve service delivery system and service organizations shall put special emphasize on Service Quality for achieving critical success, which would improve overall Customer Satisfaction, Customer Loyalty, Operational Performance and Firm Profitability.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v11n9p218

Journal Metrics

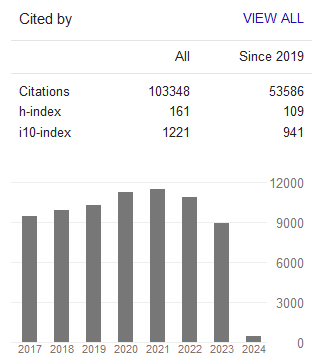

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org