Altman Model and Bankruptcy Profile of Islamic Banking Industry: A Comparative Analysis on Financial Performance

- Amin Jan

- Maran Marimuthu

Abstract

The purpose of this paper is to examine the bankruptcy profile of Islamic banking industry and perform a comparative analysis of their financial characteristics with regards to bankruptcy. This paper applied Altman model on top five Islamic banking countries by global Islamic-banking assets with the objective to examine their bankruptcy profile, while ANOVA Post Hoc Scheffe test is applied to perform a comparative analysis on their financial characteristics relating to bankruptcy. From the selected sample the Saudi Arabian Islamic banks are found less bankrupt and moreover, two Saudi Arabian Islamic banks reserved the top two spots in z-score bankruptcy ranking list. However, Malaysian Islamic banks are found more bankrupt as they entitled the bottom four positions on z-score bankruptcy profile list. On performance indicators like liquidity, profitability and insolvency with regards to bankruptcy the Islamic banks from top five Islamic banking countries has a significant relationship. However, the relationship on productivity with regards to bankruptcy among the top five Islamic banking countries is found insignificant. The analysis here is viable for drawing the attention of researchers and practitioners of Islamic banking industry towards the overall deterioration in compound annual growth rate and the identified bankruptcy rate along with comparative financial performance on bankruptcy.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v10n7p110

Journal Metrics

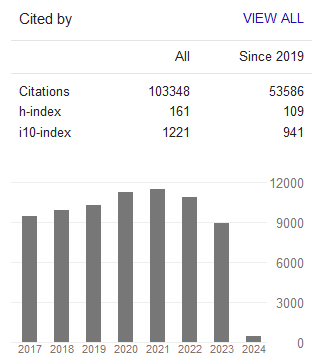

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org