Big Challenges by a Small Microfinance Institution- A Case Study of SafeSave Bangladesh from the Customer Satisfaction and ICT Introduction Perspective

- Mohammad Islam

- Chikako Takanashi

- Takashi Natori

Abstract

Bangladesh is considered as a birthplace of modern microfinance movement. This movement has mainly been

instigated by the various microfinance institutions irrespective of their size. This paper focuses on such an

innovative microfinance institution namely SafeSave (SS). SS is definitely unique in that they have adopted

information and communication technologies (ICT) and built competence in dealing with vulnerable slum

dwellers as a client even though they are a small firm in the market. This study compared the operational

uniqueness and performance of SS among large MFIs equipped with ICT and small MFIs without ICT

experience. In this context statistical analysis such as unpaired t-test and regression analysis were conducted.

Customer satisfaction of SS was higher than other types of MFIs which showed the important lesson for small

MFIs without ICT experience. Even though SS is innovative, there are scope to improve the operational

mechanism by better management and more efficient information and communication technologies.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v8n14p23

Journal Metrics

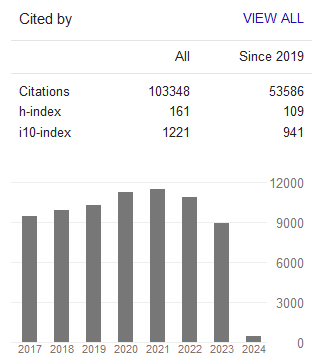

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org