Islamic Bank Service Quality and Trust: Study on Islamic Bank in Makassar Indonesia

- Irwan Misbach

- Surachman -

- Djumilah Hadiwidjojo

- Armanu -

Abstract

Main theme that is always to be a hot topic for the management of Islamic banking is how to find an appropriateway to expand its market Islamic banking. Current market contribution of Islamic banking is only around 2% of

the total national banking and only 1.6% of Muslims in Indonesia who use Islamic banks for their transactions

and investment. It showed that customers have low interest on Islamic bank. Objectives of this research were to

analyze the influence of service quality of Islamic bank on customer satisfaction and trust. Survey on 130

respondents in the city of Makassar, Indonesia was conducted to collect information to explore the relationship

between customer perception of the service quality of Islamic bank, satisfaction and trust. Accidental sampling

was used to select the respondents with criteria of not an employee of the bank, have transaction of more than

once per month and use more than one product and service of the Islamic banking. The Structural Equation

Model (SEM) is used to analyze the direct and indirect relationship between Islamic bank service quality,

satisfaction and trust. The findings of this research were that service quality of Islamic bank had significantly of

influence on customers’ satisfaction and then on their trust. Responsiveness of Islamic bank service was as the

strongest attraction for customers to the Islamic bank. On the other hand, compliance was as the weakest

attraction to the Islamic bank. Customers’ satisfaction played an important role to support service quality of

Islamic bank in influencing trust.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v8n5p48

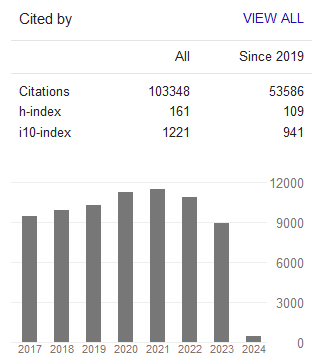

Journal Metrics

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org