Are the Asymmetric Risks Upstream in Islamic Banks an Obstacle to the Principle of Money as a Relay to Capital?

- Alim Belek

Abstract

Banks in developing countries are too much liquidity, result of the poor sectoral allocation of resources, causedby their inefficiency in the production of information and in the management of risk. The economies of

developing countries are, also, in a context of financial repression where the rates are capped at low levels

paying evil savings and do not favor the formation of capital. The great importance of liquidity at the strict sense

M1 in the monetary mass (80% according to Goldsmith, 1969) in the economies of developing countries and the

lack of substitutability between physical capital and financial capital established by McKinnon (1973) brings

him to advocate for these economies the principle of money as a relay to capital.

The alternative posed by Islamic banks, effective in the production of information (Alim B., 2011) and in the risk

management (Khan M., 1986; Alim B., 2011) favorable to a better sectoral policy, faced to a peculiar asymmetric

risk upstream of the financing operation. The purpose of the study is to show that this risk, mainly financial, has

such effect to reduce or even eliminate the utility of depositors and may constitute a barrier to the principle of

money as a relay to capital. If Islamic banking is recommendable because adapted to the financing of emerging

economies, it should be defined for this system the management mechanisms of this type of risk with evident

impact.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v8n6p139

Journal Metrics

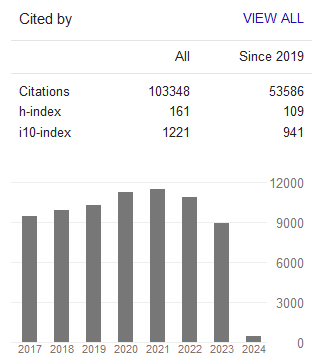

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org