Ownership Structure and Earnings Management: Evidence from Iran

- Bashir Ghabdian

- Navid Attaran

- Omid Froutan

Abstract

Family enterprises have been a major part of capital markets. By possessing most of their stock or being a

member of the board, family members are considered the main decision makers in family businesses. Earnings

on the other hand have always been a performance indicator which is under management control, most often

managed or manipulated.This research seeks to identify and compare earnings management between family and

non-family structured firms. After definingcriteria regarding family and non-family firms, 31 samples were

selected as family based and they were grouped in relevant industries according to Tehran Stock Exchange

categorization. Afterwards we randomly selected non-family firms from those industries with the same

proportion. To test the research hypothesis, Jones adjusted model (Dechow et al, 1995) and multivariable

regression model were used. The results indicate a meaningful relation between earnings management and

ownership structure of firms where in average, non-family firms engagein earnings management more often than

family ones.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v7n15p88

Journal Metrics

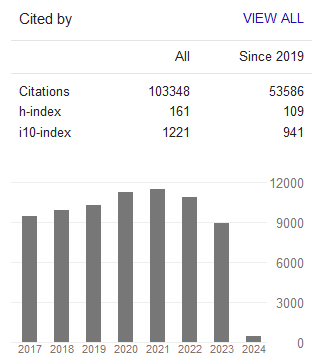

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org