Tests on the Relationship of Fund Performance and Net Fund Flow

- Wei Hu

Abstract

The relationship between net fund flow and performance of open-end funds was studied in this paper. The empirical tests on the performance and size of open-end funds in China show that the net fund flow of funds is positively correlated with pre-performance of funds, while the performance of funds is negatively correlated with the net fund flow of funds. These empirical studies imply that investors chose funds according to their historical performance, while the growing size decreases the funds’ capability of achieving excellent performance.- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v3n8p14

Journal Metrics

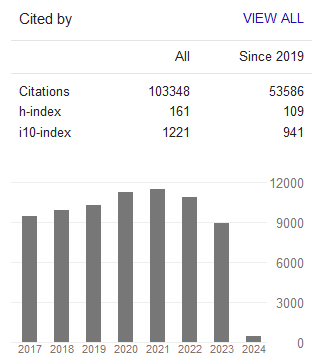

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org