The Impact of Margin Trading on Stock Volatility: Based from 2014 to 2016 Shanghai and Shenzhen 300 Index

- Chuanyang Gong

Abstract

The paper study the impact of margin trading on the volatility of the stock market, We selected 469 observation values among the daily Shanghai and Shenzhen 300 index from May 2014 to March 2016. the Granger causality test results are obtained for the model. Empirically study shows that one of the factors affecting stock price fluctuation does include margin trading business, and shows a negative correlation, which plays a more stable role in the stock market.- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v16n7p32

Journal Metrics

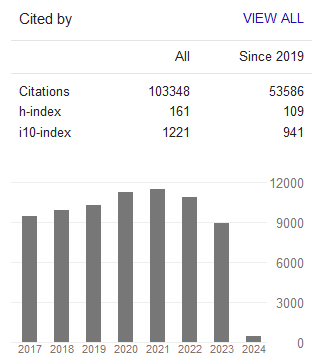

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org