Using the Financial Analysis Approach to Forecast Industrial Production: A Guide from Jordan

- H. Banikhalid

- S. Al-oshaibat

Abstract

This study aims to derive the function that can be used to predict the growth rate in the added value of industrial production in Jordan, depending on the financial ratios of industrial companies listed on the Amman Stock Exchange. To achieve the objectives of the study, the descriptive and analytical approach and multiple regression analysis were used using the SPSS program. The study population was represented by the public joint-stock companies listed on the Amman Stock Exchange in the industrial sector from 1994 to 2018. Results show that the financial ratios influencing the growth rate in industrial production value added the most (Industry t + 1) are earnings per share (EPS), net profit margin (NPM), and return on equity (ROE). Moreover, the effect is non-linear expressed by a function that can be used to predict the industrial production in Jordan. The study recommends paying attention to the partial input to predict macroeconomic variables, especially with the development of systems for storing and processing big data, as this method provides appropriate and sufficient data to make accurate decisions and enhances the right track.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v16n5p91

Journal Metrics

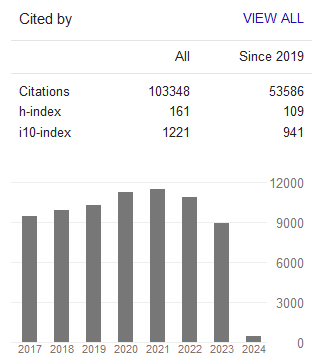

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org