Determinants of Capital Structure in Industrial Companies: Conservative Policy—Applied Study on Jordanian Industrial for the Period (2014-2016)

- Abeer Al Abbadi

Abstract

The study aimed to define the factors that determinate the capital structure for industrial companies in Jordan. By depending on theoretical references and literature review that related to capital structure, and to define the determinants that influenced the capital structure by depending on statistical analysis. The study used 15 companies of Amman stock exchange for the period 2014-2016.

The study concluded multiple results. The most importantly, there is significant impact of profitability, interest rates, and the amount of tangible assets. And there is impact of investment opportunities, the size of company and to the adoption of conservative policy according to the comprehensive concept of indebtedness in building capital structure. There was no possible impact for financial distress. The study proposed recommendations. The most important recommendations are studying the underlying causes of reduction long term debt ratio to the total assets of many public share holding companies. Urging financial managers to study the capital structure and the factors that determinate it, in order to manage the capital structure of the companies according to scientific methodology. Urging companies to use Islamic instruments for funding the tangible assets .As it is appropriate to the prevailing economic conditions in the market in terms of profit rates. It is necessary to confirm the existence of a credit rating classification from international credit agencies that helps in issuance of instruments and corporate bonds, or to obtain credit. Urging companies using rent ending in ownership or finance leasing; and urging companies of tangible assets to obtain funding from Islamic and commercial banks especially, when the cost of borrowing and Islamic funding is less than the cost of the issuance of shares. The study suggested studying the determinate factors that makes some companies following the conservative policy in building the capital structure, and in maintaining high cash balances. The study affected the impact of the existence of financial organizations as board of directors in public shareholding companies determine and study the factors of building the capital structure.

- Full Text:

PDF

PDF

- DOI:10.5539/ijbm.v14n2p125

Journal Metrics

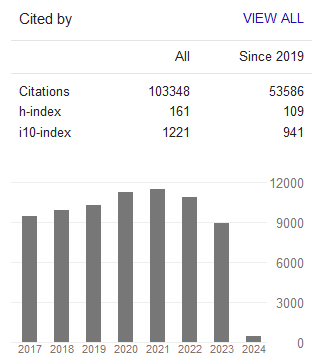

Google-based Impact Factor (2023): 0.86

h-index(2023): 152

i10-index(2023): 1168

Index

- Academic Journals Database

- AIDEA list (Italian Academy of Business Administration)

- ANVUR (Italian National Agency for the Evaluation of Universities and Research Institutes)

- Berkeley Library

- CNKI Scholar

- COPAC

- EBSCOhost

- Electronic Journals Library

- Elektronische Zeitschriftenbibliothek (EZB)

- EuroPub Database

- Excellence in Research for Australia (ERA)

- Genamics JournalSeek

- GETIT@YALE (Yale University Library)

- IBZ Online

- JournalTOCs

- Library and Archives Canada

- LOCKSS

- MIAR

- National Library of Australia

- Norwegian Centre for Research Data (NSD)

- PKP Open Archives Harvester

- Publons

- Qualis/CAPES

- RePEc

- ROAD

- Scilit

- SHERPA/RoMEO

- Standard Periodical Directory

- Universe Digital Library

- UoS Library

- WorldCat

- ZBW-German National Library of Economics

Contact

- Stephen LeeEditorial Assistant

- ijbm@ccsenet.org